If you’re in the market to buy this spring or this year, get the inside scoop with Catherine!

Rising Interest Rates: Fixed vs. Variable

The banks are jumping on the bandwagon raising the Benchmarks Rate to 5.14% combined with Strengthening Bond Yields & Record Low Unemployment Rates.

An inside look at your options and whether fixed or variable is right for you.

Tax Season is Coming Up!

A Must Read for Self-Employed First Time Homeowners

Did you know that as a first-time buyer you can take out a maximum of $25,000 from your RRSPs tax free towards your first home? *Subject to Qual.* (repayable over the next 15 years)

Have you taken advantage of your tax threshold to help you save on taxes and reach your home ownership goals faster?

Tightened Regulations for Mortgage Lending

How do the mortgage rules affect you & the market?

With the ever-changing mortgage landscape, working with a professional has never been more important.

Contact a Mortgage Professional to determine the effects on your borrowing power & your options for your upcoming mortgage lending needs.

Why the Rise from the Bank of Canada?

- Housing Sales Rising

Gradually Increasing Oil Prices

Global Expansion of Trades

Steady Decline in Unemployment & Incline in Output

Key factors which may inhibit further rises:

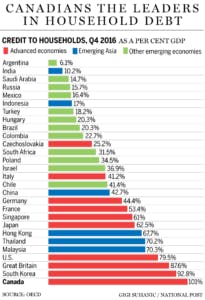

X High Household Debt both secured and unsecured

X Political Uncertainty Worldwide

X Future of NAFTA

The Big Banks Increased their 5 year fixed rates

The Big Banks Increased their 5 year fixed rates

As bond rates are on the rise, this increases the direct costs of lending money through mortgages and will result in further rises in fixed rate mortgages over the coming days / weeks.

RBC, CIBC and TD raised their 5-year posted rates last week ahead of the Bank of Canada announcement on Wednesday from 4.99% to 5.14% the highest it has been in years.

Bond Rates impact mortgage rates as one of the key “funding contributors.” Bond rates have been steadily rising over the past few months; resulting in money being more expensive to lend and therefore more expensive to borrow.

Debt servicing costs will rise with higher interest rates, which will result in tighter budgets and decreased consumer spending.

The government policies will also have a direct impact on dampening the incline in spending patterns by limiting the available borrowings. This may have a direct impact on the housing sector, which has been a key indicator of economic growth and rising BoC rates.

NEW Mortgage Stress Test

5 Year Benchmark on the rise & potential rise in the overnight lending rate

New mortgage regulations require all borrowers obtaining financing through federally regulated lenders to qualify at either the 5-year benchmark (for High Ratio Insured Mortgages) or the higher of the benchmark or the contract rate received plus 2% (for all other Mortgages).

Therefore, with a rising benchmark rate and upcoming Bank of Canada announcement, your mortgage qualifications may change or decrease. Make sure to talk to your Mortgage Professional about the effect to your qualifications.

Written By: Catherine Ellis